The insurance industry is at the cusp of a major transformation, driven by the adoption of Artificial Intelligence (AI). With the global insurance market projected to reach $6.39 trillion by 2025, insurers are increasingly looking to AI to enhance risk assessment, detect fraud, and improve customer service. This blog explores the impact of AI on the insurance industry, the potential cost savings, and how leading insurance companies are leveraging AI to stay ahead in a competitive market.

AI and the Insurance Industry: A Growing Relationship

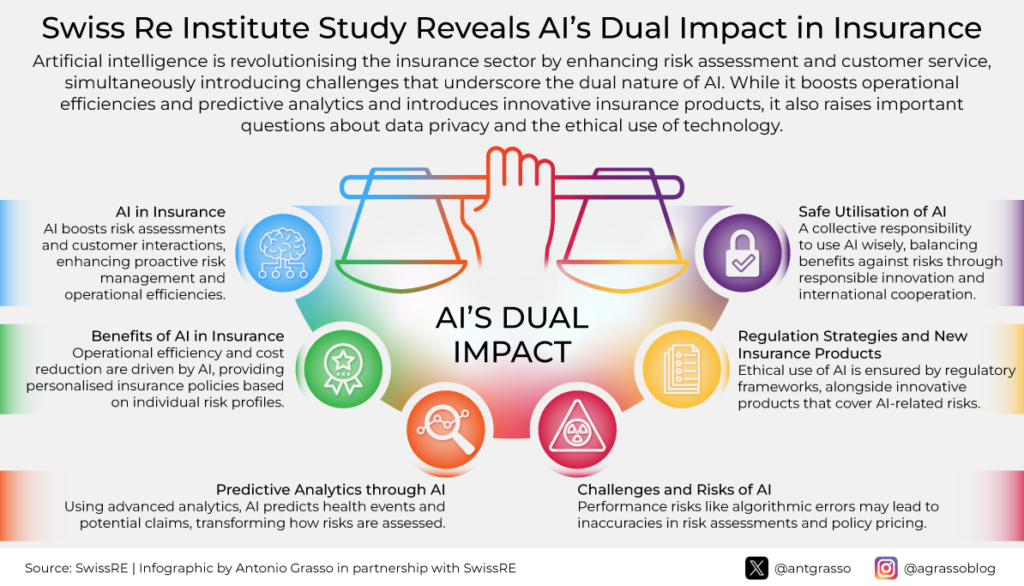

AI has become a critical tool in the insurance industry, offering solutions that enhance operational efficiency and customer experience. According to the Insurance Information Institute, AI’s integration in insurance is not just a trend but a necessity. The ability to analyze vast amounts of data in real-time allows insurers to make more informed decisions, particularly in risk assessment and fraud detection.

Market Growth and Technological Adoption

The global insurance market is experiencing significant growth, with AI playing a pivotal role. Reports from McKinsey & Company and Deloitte emphasize the importance of AI in transforming the insurance sector. By automating complex processes, AI helps insurers reduce costs, improve accuracy, and offer personalized services to customers.

How Artificial Intelligences is Drives Cost Savings in Insurance

AI’s ability to process and analyze data quickly and accurately leads to substantial cost savings in several key areas:

- Risk Assessment: AI enhances the accuracy of risk assessments, enabling insurers to offer better pricing and reduce underwriting costs.

- Fraud Detection: AI’s predictive analytics and machine learning algorithms help detect fraudulent claims early, significantly reducing losses.

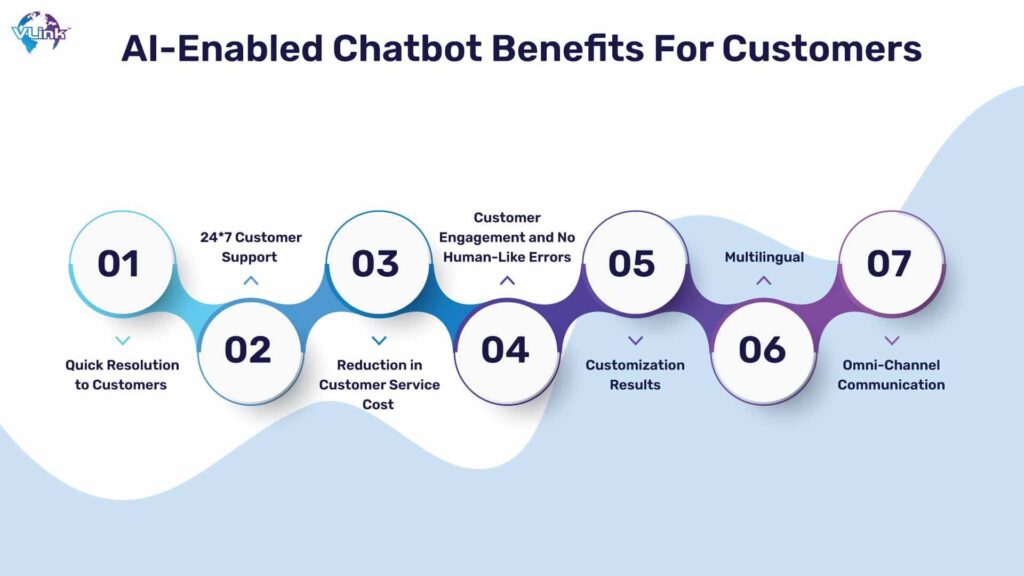

- Customer Service: AI-powered chatbots and virtual assistants improve customer service by providing instant responses and reducing labor costs.

Risk Assessment: Enhancing Accuracy and Reducing Costs

Risk assessment is a critical aspect of the insurance industry. Traditional methods rely heavily on historical data and human judgment, which can lead to inaccuracies. AI, however, offers a more precise approach. By analyzing real-time data, AI can predict potential risks with greater accuracy, allowing insurers to tailor their offerings more effectively.

For example, Selective Insurance Group has leveraged AI to improve its risk assessment accuracy, reducing underwriting costs by 15%, which translates to annual savings of approximately $454.5 million. This approach not only enhances profitability but also ensures more competitive pricing for customers.

Fraud Detection: Identifying and Preventing Losses

Fraud detection is another area where AI is making a significant impact. Insurance fraud costs the industry billions of dollars annually. AI’s machine learning algorithms can analyze patterns in claims data, flagging suspicious activities for further investigation. This proactive approach to fraud detection not only reduces losses but also deters potential fraudsters.

Markel Corporation, for instance, has implemented AI to detect fraudulent claims, resulting in a 25% reduction in losses and annual savings of approximately $2.435 billion. This significant cost reduction highlights the importance of AI in maintaining the financial health of insurance companies.

Customer Service: Revolutionizing the Customer Experience

AI is also transforming customer service in the insurance industry. AI-powered chatbots and virtual assistants provide instant responses to customer inquiries, streamline claim processing, and offer personalized recommendations. This enhanced customer experience reduces labor costs and improves customer satisfaction.

W.R. Berkley, a leading insurance company, has adopted AI-driven customer service solutions, resulting in a 25% reduction in labor costs. With annual savings of approximately $2.175 billion, W.R. Berkley’s investment in AI underscores the technology’s value in delivering superior customer service while maintaining profitability.

Financial Impact on Leading Insurance Companies

The integration of AI into insurance operations has led to substantial cost savings across the industry. Here’s a detailed look at how specific companies are benefiting from AI:

1. Selective Insurance Group

- Industry: Insurance

- Savings through AI: $454.5 million annually

- AI Applications: Enhanced risk assessment and fraud detection

Selective Insurance Group’s adoption of AI has led to a 15% reduction in underwriting costs and a 25% reduction in fraudulent claims, highlighting AI’s potential to drive significant financial gains.

2. Markel Corporation

- Industry: Insurance

- Savings through AI: $1.461 billion annually

- AI Applications: Risk assessment accuracy and fraud detection

Markel Corporation’s AI initiatives have resulted in substantial cost savings, with a focus on improving underwriting processes and reducing fraud-related losses.

3. Argo Group

- Industry: Insurance

- Savings through AI: $315 million annually

- AI Applications: Risk assessment and fraud detection

Argo Group’s use of AI in risk assessment and fraud detection underscores the technology’s ability to drive efficiency and profitability in the insurance sector.

4. W.R. Berkley

- Industry: Insurance

- Savings through AI: $1.305 billion annually

- AI Applications: Customer service, risk assessment, and fraud detection

W.R. Berkley’s comprehensive AI strategy, encompassing customer service, risk assessment, and fraud detection, has led to significant cost savings and enhanced customer experiences.

5. Mercury Insurance

- Industry: Insurance

- Savings through AI: $525 million annually

- AI Applications: Risk assessment and fraud detection

Mercury Insurance has successfully implemented AI to reduce underwriting costs and detect fraud, resulting in notable financial savings.

6. Horace Mann Educators Corporation

- Industry: Insurance

- Savings through AI: $195 million annually

- AI Applications: Risk assessment and fraud detection

Horace Mann Educators Corporation’s AI-driven approach to risk assessment and fraud detection has led to substantial savings and improved operational efficiency.

7. RLI Corp.

- Industry: Insurance

- Savings through AI: $165 million annually

- AI Applications: Risk assessment and fraud detection

RLI Corp.’s integration of AI into its operations has resulted in significant cost reductions, particularly in underwriting and fraud prevention.

8. United Fire Group

- Industry: Insurance

- Savings through AI: $180 million annually

- AI Applications: Risk assessment and fraud detection

United Fire Group has leveraged AI to enhance risk assessment accuracy and detect fraudulent claims, leading to considerable financial savings.

9. ProAssurance Corporation

- Industry: Insurance

- Savings through AI: $153 million annually

- AI Applications: Risk assessment and fraud detection

ProAssurance Corporation’s adoption of AI has led to improved risk assessment processes and a reduction in fraud-related losses, contributing to significant cost savings.

The Future of AI in Insurance: A $1.623 Trillion Opportunity

As AI continues to evolve, its impact on the insurance industry is expected to grow. With the global insurance market projected to reach $6.39 trillion by 2025, AI has the potential to generate approximately $1.623 trillion in savings across the industry. This projection is based on the average savings percentage observed in leading insurance companies, which stands at 25.4%.

The adoption of AI is not just about cost savings; it’s about staying competitive in a rapidly changing market. Insurers that embrace AI will be better positioned to offer personalized services, enhance customer experiences, and reduce operational costs, all while maintaining profitability.

Conclusion: Embracing for the Competitive Edge

The insurance industry is undergoing a transformation driven by AI. From improving risk assessment accuracy to detecting fraud and enhancing customer service, AI offers a pathway to significant cost savings and operational efficiency. As the global insurance market continues to grow, companies that adopt AI will be better equipped to navigate the challenges and opportunities of the future.

By investing in AI, insurance companies can not only reduce costs but also offer more competitive pricing, improve customer satisfaction, and maintain a strong financial position in a highly competitive industry.

Sources:

- Insurance Information Institute. “The Future of AI in Insurance.”

- McKinsey & Company. “AI in Insurance: Impact and Opportunities.”

- Deloitte. “Transforming Insurance with AI: A New Era of Efficiency.”

Learn more about other industries leading the charge with AI by visiting my blog.